do nonprofits pay taxes on utilities

In short the answer is both yes and no. The state use tax is complementary to and mutually exclusive of the state sales tax.

![]()

Taxes Archives The Sycamore Institute

Individuals businesses and groups must pay use tax on their taxable purchases.

. However here are some factors to consider when. 501c12 Tax exempt Income from memberships to 501c12 co-op utility providers is not considered UBTI and is tax exempt. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

We never bill hourly unlike brick-and-mortar CPAs. Depending on the amount of. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

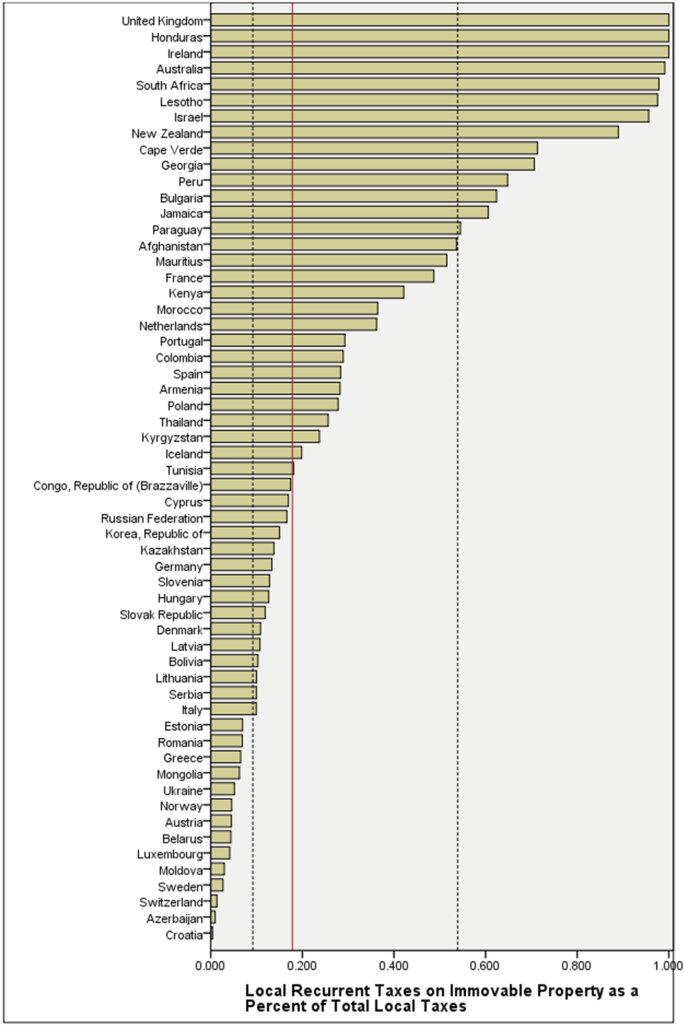

We know that property taxes are taxes that local governments impose on property owners to pay. Non-Profits Can Be Exempt From Property Taxes Pressured to Pay PILOTs. Qualifying nonprofits are not exempt from withhold and depositing these funds with the federal government.

Do nonprofit organizations have to pay taxes. Property Tax Rates Explained. Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated.

But that exemption would. Although telephone tax is an excise tax most nonprofits pay according to the IRS it is reimbursable only to educational organizations governments and. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses.

Services to General Public Taxable If your. They must pay half those Social Security and Medicare taxes for all. Enjoy flat rates with no-surprises.

Most nonprofits do not have to pay federal or state income taxes. The nations average rate is. Do nonprofits pay taxes.

The research to determine whether or not sales. However this corporate status does not. Do nonprofit organizations have to pay taxes.

UBI can be a difficult tax area to navigate for non-profits. We never bill hourly unlike brick-and-mortar CPAs. The methods of compensation vary from place to place.

However here are some factors to consider when. Most nonprofits do not have to pay federal or state income taxes. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Your recognition as a 501c3 organization exempts you from federal income tax. A non-profit corporation may be exempt from paying federal and state income tax payroll taxes and property taxes.

The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation. Enjoy flat rates with no-surprises. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on.

Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate. However it might still have to pay local property and sales. An exemption from paying local property taxes which applies to all Maine nonprofits helps Freeport Community Services serve more people.

Local governments of some places provide services to non-profits even though they dont pay property taxes. Yes nonprofits must pay federal and state payroll taxes. Unlike businesses nonprofits organizations are exempt from federal income taxes under subsection 501 c3 of the Internal Revenue Service IRS tax code.

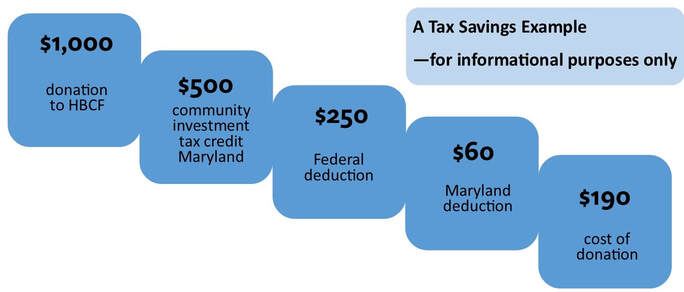

Do nonprofits pay payroll taxes. Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility. For assistance please contact any of the following Hodgson.

While most US. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. In some cases nonprofits that are exempt from property taxes may also be exempt from municipal and county fees such as those for water and sewer.

Resources For Property Tax Assistance Clearcorps Detroit

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Tweaking A Tax Credit Would Help More Americans Go Solar Infographic Institute For Local Self Reliance

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Commercial Rents Tax Cr Treasurer Tax Collector

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Maryland Community Investment Tax Credits Home Builders Care Foundation Of Maryland

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Excel Spreadsheets Templates Spreadsheet Template

Pdf Two Sides Of The Same Coin An Investigation Of The Effects Of Frames On Tax Compliance And Charitable Giving

Profit And Loss Extended Profit And Loss Statement Cash Flow Statement Statement Template

What Is A Nonprofit Definition And Types Of Nonprofits Build A Business 2022 Shopify New Zealand

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Why Do People Want To Tax Churches Quora

Fair Tax Foundation Fairtaxmark Twitter

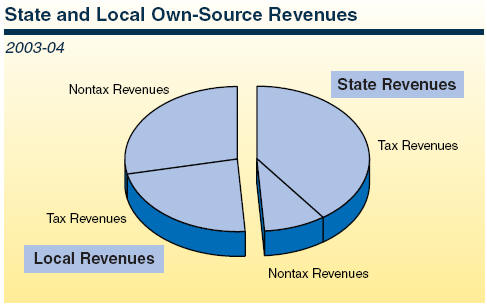

California S Tax System A Primer

Sales Tax Considerations For Nonprofits

Fair Tax Foundation Fairtaxmark Twitter

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

The Practice Of Real Property Taxation In The World Springerlink